What to Expect During the Home Appraisal Process

When buying or selling a home, one of the most critical steps is the home appraisal. This process determines the fair market value of a property and helps ensure that buyers, sellers, and lenders have a clear understanding of what the home is truly worth. While it may seem intimidating, understanding what to expect during an appraisal can help you prepare and navigate the process with confidence.

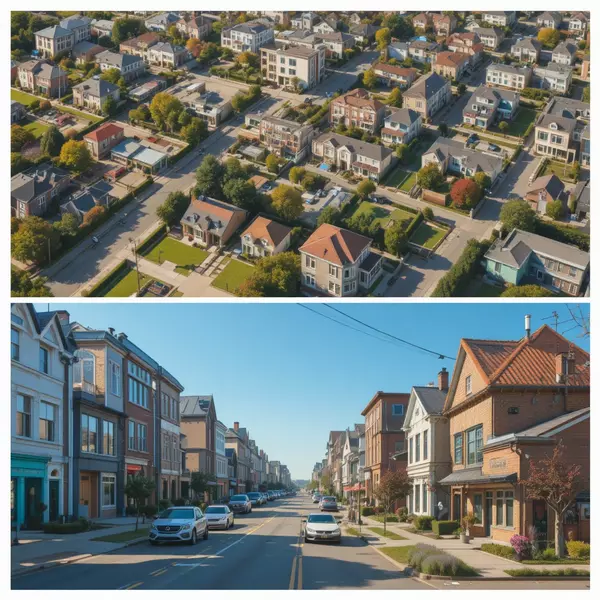

A home appraisal is typically ordered by the lender after an offer has been accepted. The appraiser, an independent third-party professional, evaluates the property’s condition, size, features, and location. They also consider recent sales of comparable homes in the area to determine a fair and accurate value. The goal is to confirm that the agreed-upon purchase price aligns with current market conditions and that the lender’s investment is protected.

Before the appraiser arrives, it’s essential to ensure your home is in its best possible condition. While appraisers focus mainly on objective factors like structure and market value, first impressions still matter. Clean your home thoroughly, complete any minor repairs, and highlight key upgrades such as renovated kitchens or bathrooms. Well-maintained landscaping and a welcoming entryway can also positively influence the appraisal outcome.

During the visit, the appraiser will inspect both the interior and exterior of the home. They will take measurements, note the number of rooms, and assess the quality of materials and finishes. They may also look for any visible issues such as leaks, cracks, or outdated systems that could impact value. Typically, the entire process takes between 30 minutes to an hour, depending on the property’s size and condition.

Once the evaluation is complete, the appraiser compiles a detailed report that includes photos, measurements, and comparisons with similar properties in the neighborhood. This report is then sent to the lender, who uses it to finalize loan approval. If the appraisal value matches or exceeds the purchase price, the transaction can move forward smoothly. However, if it comes in lower, buyers and sellers may need to renegotiate the price or explore other financing options.

Understanding the home appraisal process helps reduce stress and ensures smoother communication between all parties involved. Whether you’re a buyer eager to confirm you’re paying a fair price or a seller hoping to justify your home’s value, preparation and knowledge are key. By maintaining your property well and keeping realistic expectations, you can help ensure a positive appraisal experience and a successful real estate transaction.

Categories

Recent Posts